An

infographic, explaining the retail selling price of petrol, was being

circulated in the social media by IT cell of BJP. We are living in a world

where even Government published data needs scrutiny, so how can a party led

information be not scrutinized. So let's get to work.

The infographic shows retail selling price of petrol in Delhi on 16/09/2017 is ₹70.48/ltr and the tax components shared between State and Union as:

Delhi Government

= ₹27.44/ltr

Central Government

= ₹12.46/ltr

This prima facie

creating an impression that Delhi enjoys more than double petrol tax compared

with Centre.

Firstly, the above

claim is having a manifest arithmetical error. Simple addition of State VAT of ₹14.98 with the purported central government share of excise duty ₹9.02 gives only ₹24.00, not ₹27.44 as depicted in the above infographic. This may be an inadvertent error

due to oversight.

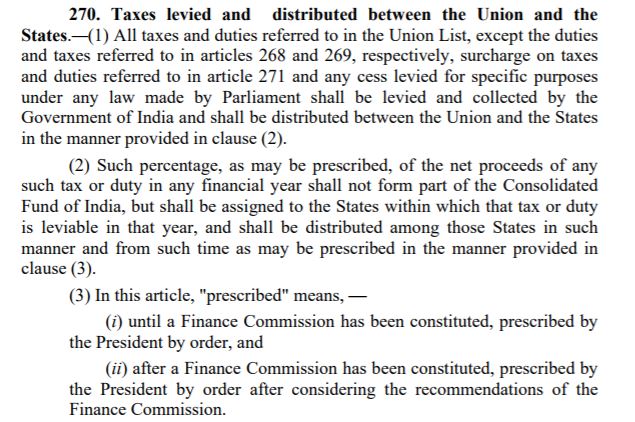

Next question is

whether 42% of Central Excise Duty transferred to State Government or not? Is it

an act of goodwill by the Big Brother, i.e., the Centre? Not really, but

it's mandated by our Constitution - See article 270, which deals with

sharing of the taxes collected by the Union with the States.

Constituent Assembly debates will shed more light to the

historical perspective of this article.

On 5th August 1949, while discussing this article, Sri. B. Das,Orissa did not mince his words:

“Sir, I do hope the provinces will not be treated as charity boys of the

North Block of the Secretariat. Somehow it has happened that people have to

come with begging bowls. Whether it is in regard to the Food Commission or the

Bengal food problem of 1943, nobody wants charity. We put forth the just

demands of the people of India and the Centre, which was an autocratic

Government intended to maintain the British Raj in the past should give up that

mentality and should part with the legitimate resources to the provinces. I do

not ask any further and I do not at present ask anything more.”

Sharing

of taxes collected by the Centre with the States is very much part of the

federal structure envisaged under the Constitutional scheme. President of

India under Art.280 appoints a Finance Commission in every five years. This

Commission recommends how the taxes under the ‘divisible pool’ has to be divided

among the States.

The following taxes are coming under the divisible pool:

The following taxes are coming under the divisible pool:

· Corporation Tax

· Income Tax

· Customs Duty

· Excise Duty

· Service Tax

But neither surcharge nor cess collected by the Central Government is part of the divisible pool.

14th Finance Commission Report recommended to share 42% of the taxes belonging to the divisible pool, which is collected by the Centre with the States.

Then,

it is evident from the above table that each State is getting a certain

percentage share from this total 42%. Hence, adding entire 42% of excise duty

to a single State, as shown in the infographic is misleading. For example,

Kerala receives 2.5% of this total 42%.

So under the Federal concept, Centre has to share 42% of the above taxes collected throughout the country with all the States. Let us have a comparison of the share of excise duty component alone (basic excise duties of all items including petrol and diesel) allocated among a couple of States.

So under the Federal concept, Centre has to share 42% of the above taxes collected throughout the country with all the States. Let us have a comparison of the share of excise duty component alone (basic excise duties of all items including petrol and diesel) allocated among a couple of States.

State

|

% of share under Divisible Pool

|

Amount in Crores

|

Kerala

|

2.500%

|

2486.93

|

Tamil Nadu

|

4.023%

|

4001.97

|

Karnatka

|

4.713%

|

4688.37

|

Uttar Pradesh

|

17.959%

|

17865.14

|

Madhya Pradesh

|

7.548%

|

7508.55

|

Rajasthan

|

5.495%

|

5466.28

|

Delhi

|

Nil

|

Nil

|

(Source: Receipts Budget, Government of India, 2017-18)

Neither

Delhi nor other Union Territories find a place in this table. This is because

Art. 270 & Art.280 deals with only sharing of revenue among Union and

States. Without either full Statehood or amendment of the above articles, Delhi

is not eligible to get a share from this divisible pool. So as far as Delhi is

concerned, their income from the petrol tax is limited to VAT alone, ie,

₹14.98.

Let us examine whether Centre shares the entire excise duty of ₹21.48 with the States or not.This ₹21.48/ltr excise duty on

petrol consists of three components:

Basic Cenvat Duty

= ₹8.48/ltr

Additional Excise Duty

= ₹6.00/ltr

Special Additional Excise Duty =

₹7.00/ltr

Additional

Excise Duty introduced through Finance Act (No.2), 1998, which is known as

‘road cess’. Sub section (4) of Section 111, clearly states this shall not be

distributed among the States.

Special

Additional Excise Duty introduced through Finance Act, 2002. Sub Section (1) of

Section 147 of the Act, explicitly makes it clear that this is for exclusive

purpose of the Union and it is a surcharge.

If any further doubts remains, scanning this year’s budget documents will clear the air. Basic

and Special Excise Duties excluding Cess on Motor Spirit and High Speed Diesel

Oil anticipated is ₹2,40,000 crores and the share kept aside from this excise

duty for States wise distribution in the budget is ₹99477 crores (41.5%), matching with the Finance Commission recommendation.

From

the receipt budget for 2017-18, it is evident that Central Government also collects the following duties in addition to the above excise duty, but which are not shared with

States.

Additional Duty of Excise on Motor Spirit

|

₹ 22,000 crores

|

Additional Duty of Excise on High Speed

Diesel Oil

|

₹ 59,250 crores

|

Special Additional Duty of Excise on Motor

Spirit

|

₹ 21,300 crores

|

GRAND TOTAL

|

₹ 1,02,550 crores

|

It is

now amply clear

that the share due to all States from the petrol tax in the divisible pool only

consists 42% of the basic excise duty of ₹8.48/ltr, ie, only ₹3.56 and Centre retains

States are getting only ₹3.56 out of the total exicse duty of ₹21.48, which amounts to 16.6% of the total excise duty on petrol, which is being collected under various heads by the Central Government. This share to the divisible pool is then divided among the States as per the formula of the 14th Finance Commission. As an example, Kerala gets 2.5% of this ₹3.56, ie, only 8.9 paise/litre of petrol, which is being collected by the Central Government.

States are getting only ₹3.56 out of the total exicse duty of ₹21.48, which amounts to 16.6% of the total excise duty on petrol, which is being collected under various heads by the Central Government. This share to the divisible pool is then divided among the States as per the formula of the 14th Finance Commission. As an example, Kerala gets 2.5% of this ₹3.56, ie, only 8.9 paise/litre of petrol, which is being collected by the Central Government.

Then

another infographic by the BJP IT Cell mentioned that Kerala and Delhi charges 34% and 27%

VAT respectively on Petrol. But they had conveniently ignored the fact that BJP ruled Maharashtra

charges 46.52% and Madhya Pradesh charges 38.79% VAT on the same.

To

summarise:

- The narrative that each State Government getting 42% of the Excise Duty collected by the Central Government is not true.

- Each

State gets a share of taxes from the divisible pool based on the

percentage share as per 14th Finance Commission.

- The

Union Government only shares 42% of the Basic Excise Duty

and not the Additional Excise Duty and Special Additional Excise Duty with

the States.